| 작성자 | Wayne | 작성일 | 2025-09-10 01:51 |

|---|---|---|---|

| 제목 | Understanding Loans For Bad Credit: A Comprehensive Examine | ||

| 내용 |

본문 IntroductionIn today’s monetary panorama, acquiring a loan is usually a daunting process, particularly for people with bad credit score. Bad credit score typically refers to a low credit rating, which may result from various elements equivalent to missed funds, high credit score utilization, or bankruptcy. This report aims to supply an in-depth analysis of loans accessible for people with unhealthy credit, exploring the varieties of loans, their implications, alternate options, and methods for improving creditworthiness. Understanding Bad CreditBad credit score is mostly outlined as a credit score rating below 580 on the FICO scale, with decrease scores indicating the next danger to lenders. Several components contribute to a nasty credit score, including:

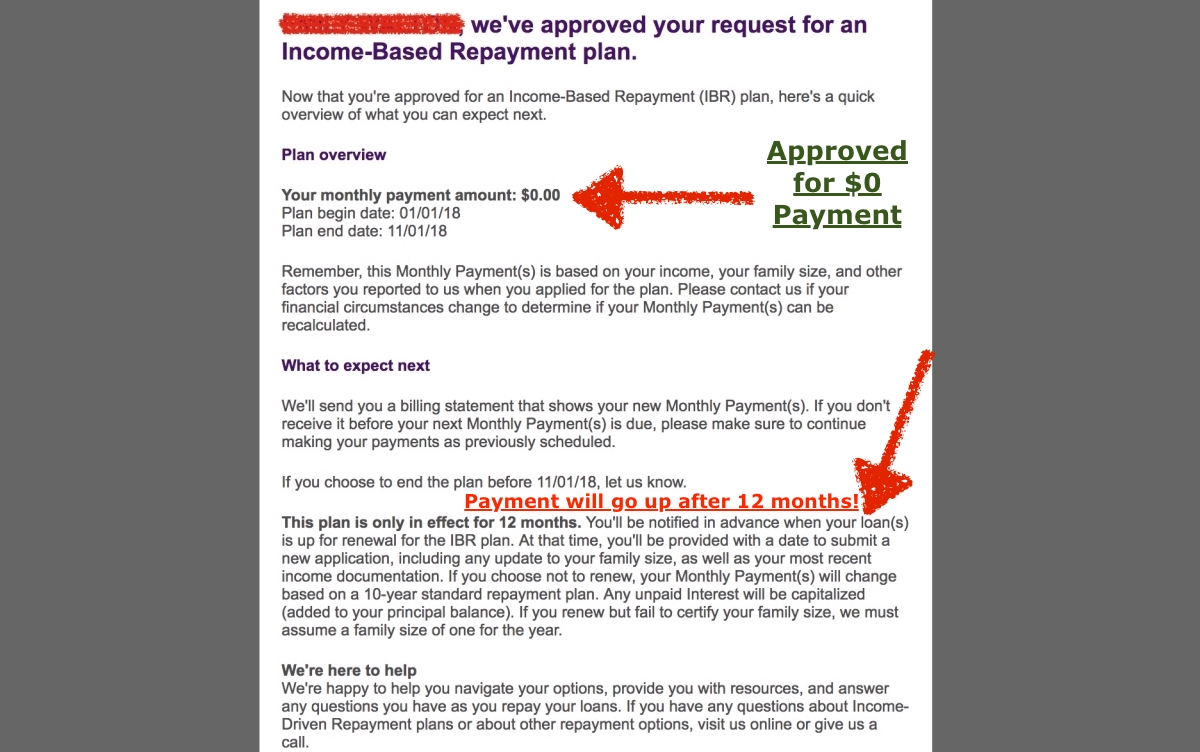

Varieties of Loans for Bad CreditIndividuals with dangerous credit have several choices relating to securing a loan. These include: 1. Personal Loans:personal loan bad credit pre approval loans are unsecured loans that can be used for varied purposes, resembling debt consolidation or unexpected bills. Lenders specializing in bad credit loans usually offer personal cash loans for very bad credit with higher interest rates and shorter repayment terms. Borrowers should shop round for the best phrases and avoid predatory lenders. 2. Secured Loans:Secured loans require collateral, comparable to a automobile or savings account, which reduces the lender's threat. Because collateral is concerned, secured loans might come with decrease curiosity charges compared to unsecured loans. Nonetheless, borrowers danger dropping their collateral in the event that they default. 3. Payday Loans:Payday loans are quick-term, high-interest loans designed to cowl pressing bills until the borrower’s subsequent paycheck. While they're simply accessible, they usually come with exorbitant curiosity rates and fees, resulting in a cycle of debt for i need a small personal loan with bad credit lot of borrowers. 4. Peer-to-Peer Loans:Peer-to-peer lending platforms join borrowers immediately with particular person buyers. These loans could be more flexible than traditional financial institution loans, but curiosity charges should be high for those with bad credit. 5. Credit score Builder Loans:Credit builder loans are designed to help individuals improve their credit score scores. The loan quantity is held in a bank account while the borrower makes fastened monthly funds. Once the loan is paid off, the borrower receives the funds, and their fee history is reported to credit score bureaus. Implications of Bad Credit score LoansWhereas loans for bad credit can provide fast financial relief, they include important implications that borrowers should consider: 1. Larger Curiosity Charges:Lenders perceive people with unhealthy credit as high-threat borrowers, leading to higher curiosity rates. This may end up in paying significantly extra over the life of the loan. 2. Shorter Loan Phrases:Many lenders provide shorter repayment intervals for dangerous credit loans, which can lead to increased monthly funds that pressure borrowers’ budgets. 3. Potential for Debt Cycle:Borrowers may discover themselves trapped in a cycle of debt attributable to excessive-curiosity charges and fees associated with dangerous credit score loans. This could make it tough to repay current debts, resulting in additional financial distress. 4. Affect on Credit Score:Taking out a loan can impact a borrower’s credit score score positively or negatively depending on their cost conduct. Well timed payments can improve credit score scores, while missed payments can exacerbate the problem. Alternatives to Bad Credit score LoansEarlier than resorting to loans, individuals with bad credit score ought to consider alternative options: 1. Credit Counseling:Working with a credit counselor will help individuals develop a budget, negotiate with creditors, and create a plan to manage debt. 2. Debt Consolidation:Consolidating multiple debts into a single loan with a decrease interest fee can simplify funds and cut back general debt costs.  3. Family and Mates:Borrowing from family or buddies is usually a viable option, often with extra favorable phrases than conventional lenders. 4. Authorities Assistance Programs:Various government programs provide financial assistance for particular situations, akin to housing or medical bills. Strategies for Improving CreditworthinessEnhancing one’s credit score score is crucial for accessing higher loan options sooner or later. Listed below are efficient strategies: 1. Make Well timed Payments:Establishing a historical past of on-time funds is without doubt one of the most vital components in improving credit score scores. 2. Reduce Credit Utilization:Protecting credit card balances low relative to credit limits can positively affect credit score scores. 3. Keep away from Opening New Credit Accounts:Each new credit inquiry can barely lower a credit score. Limiting new accounts will help maintain a stable rating. 4. Frequently Test Credit score Reports:Monitoring credit score reports for errors and disputing inaccuracies will help maintain a fair credit score rating. 5. Consider Secured Credit score Cards:Using a secured credit card responsibly can assist rebuild credit over time. These playing cards require a money deposit that serves as the credit score restrict. ConclusionSecuring loans with unhealthy credit score is a challenging endeavor that requires careful consideration of options and implications. Whereas loans for bad credit can present needed financial assist, they often include excessive prices and dangers. Individuals should discover alternatives and deal with bettering their creditworthiness to access better monetary products in the future. By understanding the landscape of dangerous credit score loans and taking proactive steps, borrowers can navigate their financial challenges extra successfully. References

|

||

관련링크

본문

Leave a comment

등록된 댓글이 없습니다.